No one knows what happens when we die, but here's what experts have gleaned from history and some near-death survivors who said they glimpsed the other side.

What happens when you die is perhaps one of the greatest mysteries on Earth, simply because none of us know the answer and yet all of us will experience death eventually.

Humankind’s great thinkers have been pondering this question for millennia. And in 1994, an orthopedic surgeon named Tony Cicoria may have come close to solving this great mystery when he was struck by a nearly-fatal bolt of lightning in upstate New York. Cicoria felt himself fly backward and the next thing he remembered was turning around to see his body lying on the ground behind him.

For a moment, Cicoria reported, he stood there and watched a woman perform CPR on his body before he floated up a flight of stairs to watch his children play in their rooms.

“Then I was surrounded by a bluish-white light,” Cicoria recalled, “an enormous feeling of well-being and peace… The highest and lowest points of my life raced by me. I had the perception of accelerating, being drawn up… Then, as I was saying to myself, ‘This is the most glorious feeling I have ever had’ — slam! I was back.”

PixabayAll of the world’s civilizations throughout human history have contemplated what happens when we die, both scientifically and spiritually — and the answers have always varied quite a bit.

According to Dr. Sam Parnia, who has studied near-death experiences for years, Cicoria’s encounter was not an uncommon one.

“Death is a process,” Parnia added. “it is not a black and white moment.”

In recent years, doctors like Parnia and close-call survivors like Cicoria have helped deepened humanity’s understanding of what happens when we die.

What Science Says About What Happens When You Die

While we may not fully understand the feeling of dying until we experience it for ourselves, we do know what happens to our bodies right before and after death.

At first, according to Dr. Nina O’Connor, a person’s breathing will become irregular and unusually shallow or deep. Their breath can then begin to sound like a rattle or a gurgle, which happens because the person isn’t able to cough up or swallow secretions in their chest and throat.

“All of it comes from the process of the body slowing and shutting down,” she says. This sound has been fittingly called “the death rattle.”

Then, at the moment of death, every muscle in the body relaxes. This may cause the person to moan or sigh as any excess air is released from their lungs and into their throat and vocal cords.

David Howells/Corbis via Getty ImagesCorpses decay at the world’s first body farm at the University of Tennessee.

Meanwhile, as the body relaxes, the pupils dilate, the jaw may fall open, and the skin sags. If the person has any urine or feces in their body, these will then be released too.

But as Parnia suggested, death doesn’t happen in an instant and some researchers assert that our brains can operate up to ten minutes after our hearts stop beating.

Within the first hour after death, the body begins to experience the “death chill” or algor mortis. This is when the corpse cools from its normal temperature to the temperature of the room around it.

After a couple of hours, blood will begin to pool in the areas of the body that are closest to the ground due to gravity. This is known as livor mortis. If the body stays in the same position for several hours, these body parts will start to look bruised while the rest of the body grows pale.

Limbs and joints will then begin to stiffen within a few hours after death during a process called rigor mortis. When the body is at its maximum stiffness, the knees and elbows will be flexed and the fingers and toes may appear crooked.

But after around 12 hours, the process of rigor mortis will start to reverse. This is due to the decay of internal tissue and it lasts between one and three days.

During this reversal, the skin begins to tighten and shrink, which can create the illusion that the person’s hair, nails, and teeth have grown. This skin tightening is also responsible for the illusion that blood has been sucked from the corpses, which in turn inspired some of the vampire legends of medieval Europe that we still know today.

What Physicians Say It Feels Like When We Die

PixabayAccording to some physicians, death can feel like either a great depression or the need to poop.

Aside from the science of death and decomposition, humans have always also sought to know what the sensation of dying feels like. Because most of us, unlike Cicoria, won’t ever have a near-death experience, we are simply left wondering: What does it feel like to die?

And according to general practitioner Dr. Clare Gerada, death can sometimes feel like having to use the bathroom.

“Most people will die in bed, but of the group that don’t, the majority will die sitting on the lavatory. This is because there are some terminal events, such as an enormous heart attack or clot on the lung, where the bodily sensation is as if you want to defecate.”

If a person doesn’t die from a terminal event, however, and instead passes on more slowly from a long-term illness or old age, dying may feel a bit like depression. Toward the end of their lives, people tend to eat and drink less, which results in fatigue and a lack of energy. This causes them to move, talk, and think slower.

Dr. O’Connor adds that “the physical fatigue and weakness [of people near the end] is profound. Simple things, like getting up out of bed and into a chair could be exhausting — that could be all of someone’s energy for a day.”

But because it’s so often difficult or impossible for dying people to express how they’re feeling during the event, the question of how it feels when we die remains largely shrouded in mystery.

What Happens To Your Body After You Die?

While the more ineffable matters of what it feels like to die may always be fuzzy, what’s very clear is what happens to the body in a practical sense after death. But how we handle our dead bodies and what ceremonies and rites we perform still varies greatly around the world.

Typically in the West, bodies are embalmed after death. The process of embalming dates back to the ancient Egyptians — and even earlier — when some cultures mummified their dead in the hopes that their soul could one day return to the corpse. Aztecs and Mayans likewise had a history of mummifying their dead, as did many of the world’s most studied civilizations in the pre-modern era.

But as for modern, Western practices, embalming in the U.S. only became popular during the Civil War as a means of transporting fallen soldiers back to their families to be buried.

Modern embalming is a meticulous process. As soon as a doctor has certified that a person is dead, the body is transported to a coroner who may request a postmortem examination. This process requires a pathologist to complete an external and internal examination. For the internal examination, the pathologist removes every organ of the body, from the tongue to the brain, and then inspects them and places them back in the body.

Next, the body is drained of all its fluids, which are replaced with a preservative like formaldehyde. Meanwhile, the throat and nose are packed with cotton wool.

The mouth is stitched or glued closed from the inside. The hair is washed, the nails are cleaned and cut, and cosmetics are applied to the face and skin. Plastic caps are applied under the eyelids to help them hold their shape.

Finally, the body is dressed and placed in a coffin. From here, it can be buried or cremated, depending on the person’s preference, culture, or religion.

In many non-Western cultures, in fact, death rituals are very different from what most of us might know.

Sijori Images/Barcroft Images/Getty ImagesWhat happens after you die is a question with a unique answer in the Toraja culture, in which they dress up long-deceased family members and walk them around.

This is especially true for the Toraja people of Indonesia. They believe that the dead are never really gone, so people are not so quick to dispose of their loved ones’ bodies.

When a Toraja person dies, their family cares for their body until a proper funeral can be prepared — which can take weeks to months or even years.

During this time, the deceased is treated as if they are simply sick instead of dead. Once the funeral is finally ready, the Toraja village honors the dead with prayers, dancing, and animal sacrifice before they take the body to its tomb.

However, the body is not left in its tomb forever. Every one to three years, the Toraja people exhume their loved ones, wipe them clean, dress them in new clothes (and sunglasses), and walk them around so that they can do things like introduce them to any new family members.

Jews, on the other hand, do not embalm their loved ones and instead bury them quickly after they are declared dead. Rabbi Corey Helfand says, “[According] to the texts we read in Genesis, with Adam coming from the Earth, we give our bodies back to the Earth and to God — that’s why we bury our dead.”

Jews are thus typically buried naked, wrapped in a cotton sheet, and laid in a plain pine coffin so that the body may decompose naturally. Muslims do the same with their dead, burying them without a coffin in some cases.

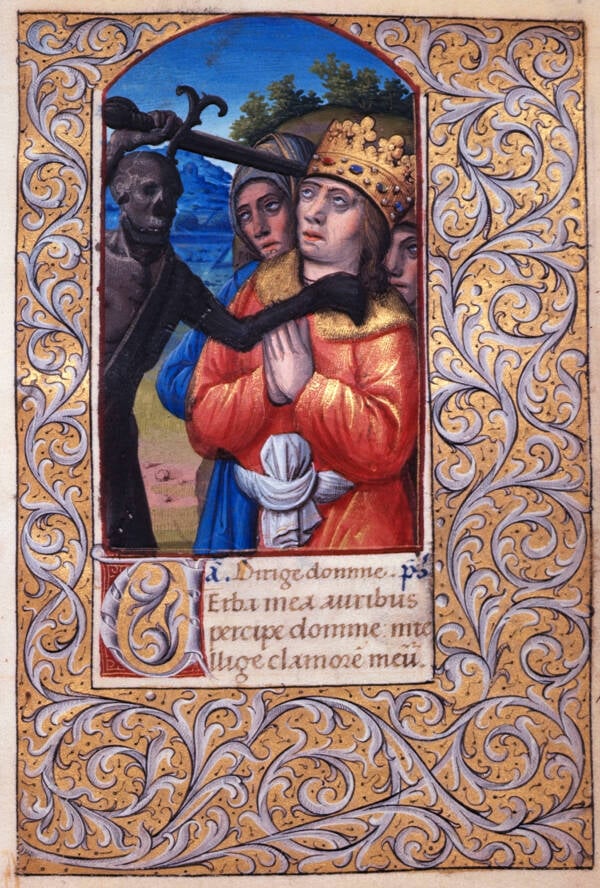

Public DomainA depiction of death personified and holding a sword, circa 1500, taken from Book of Hours, containing prayers and rites.

Medieval Christians, on the other hand, lived their lives considering and preparing for death, mostly because they were surrounded by it. Without modern medicine, there were high rates of infant mortality and disease, while famine and war were also rampant. This was the age of the Black Death, after all. Christian Europeans (and Americans) thus still tend toward death rituals that are more highly prepared and orchestrated in terms of things like coffins and funerary rites.

Meanwhile, the ancient Egyptians believed that the dead had to first pass through the underworld before they could rest in the afterlife. But the journey to the afterlife was riddled with obstacles, so the ancient Egyptians buried their loved ones with scrolls inscribed with spells to protect and guide them to their final resting place. Archaeologists have even found maps of the underworld in tombs meant to direct the dead in the afterlife.

What Really Happens After You Die — From People Who’ve Been There

Setting aside what happens to the deceased’s body after they die, what happens to them, to their very being and their soul? While the world’s cultures and religions can offer some possible answers, so can survivors of near-death experiences.

In 1988, actress Jane Seymour went into anaphylactic shock. As her body began to shut down, her mind stayed aware.

“I had the vision of seeing a white light and looking down and seeing myself in this bedroom with a nurse frantically trying to save my life and jabbing injections in me, and I’m calmly watching this whole thing,” she said, describing a scene common in reports from those who have almost died.

Dr. Sam Parnia recorded this phenomenon with multiple survivors during his 2014 study of near-death experiences. One patient could recall what was happening in the hospital for a full three minutes after his heart had stopped.

“The man described everything that had happened in the room, but importantly, he heard two bleeps from a machine that makes a noise at three-minute intervals,” said Parnia. “So we could time how long the experience lasted for. He seemed very credible and everything that he said had happened to him had actually happened.”

While not every survivor that Parnia spoke with had an out-of-body experience, as many as 40 percent of them do recall having some sort of “awareness” when they were declared clinically dead.

Even after flatlining, many survivors recall seeing a bright, welcoming light, or their deceased relatives, or the doctors and nurses working on them in the hospital.

What’s more, many of the people who experienced consciousness after death remember not wanting to return to their bodies.

However, many scientists remain skeptical of these reports and attribute them to everything from lucid dreaming to a lack of oxygen in the brain. While more research needs to be done before we know for sure what happens when we die, perhaps it is at least comforting to think that our consciousness floats on as our bodies expire.

After learning about what happens when we die, read up on the most unusual deaths in history. Then, check out these haunting photos of people right before they died.